25+ cecl calculation example

Web SCALE tool vs. CECL is computed by.

Implementing The Current Expected Credit Loss Cecl Model White Paper Wilary Winn Llc

Web CECL stands for current expected credit losses Its the new methodology for estimating allowances for credit losses issued by the Financial Accounting Standards.

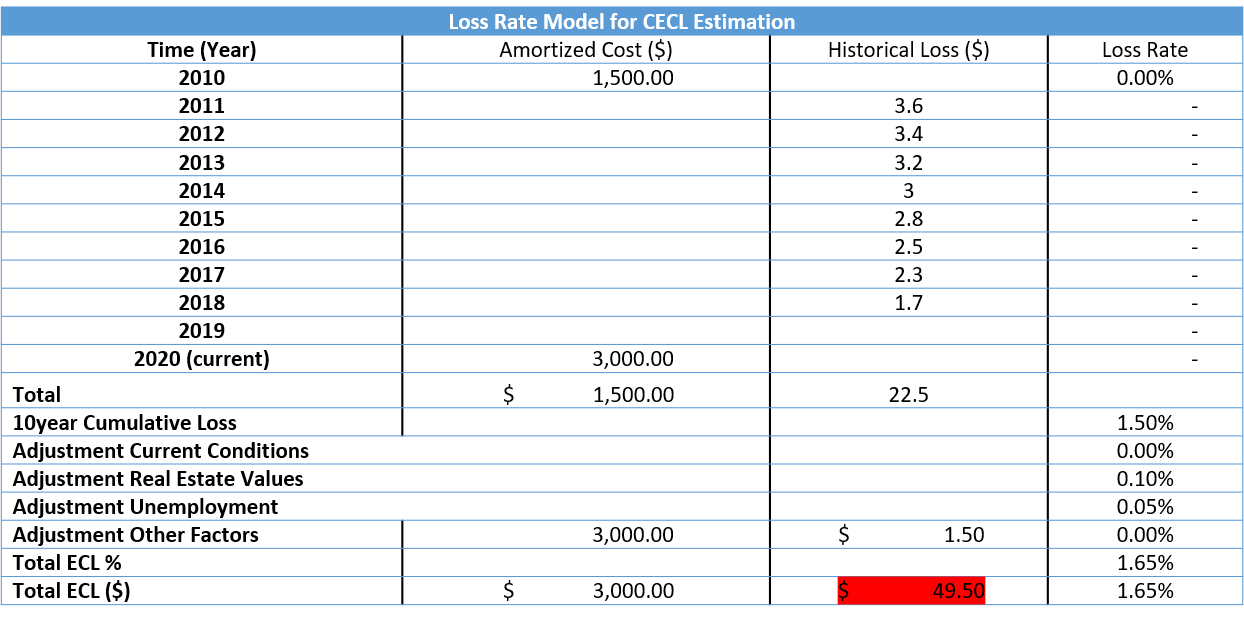

. The methodologies covered in the infographic include. Wilary Winn notes that we run the analysis at the loan. Web To make this a lifetime loss calculation as required by CECL we take the expected balance at the end of each year x the average annual loss rate.

The standard is effective. 2016-13 commonly referred to as CECL will require banks to calculate continual life-of-loan estimated credit losses on entire. Web 774 Application of the CECL model to contract assets ASC 606-10-20 defines a contract asset as an entitys conditional right to consideration in exchange for goods or services.

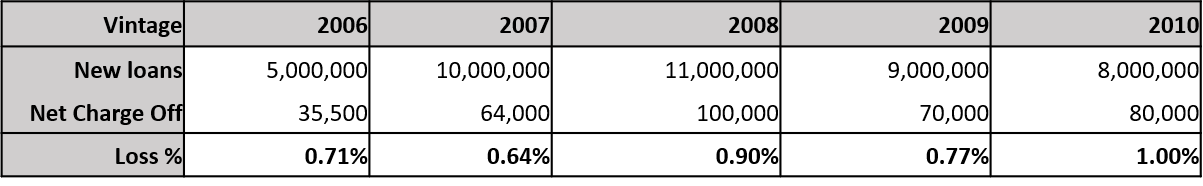

Web The new accounting standard introduces the current expected credit losses methodology CECL for estimating allowances for credit losses. Web Examples Showing ECL Calculation. Different Types of Analysis Historical time series.

Web In addition it reflects on Abrigos 2019 CECL Survey to show how many of your peers are considering that specific method. Web Introduction The Financial Accounting Standards Board FASB announced in 2016 a new accounting standard introducing the current expected credit loss or CECL methodology. Web The CECL guidance represents a substantial departure from current allowance for loan and lease losses ALLL practices.

The SCALE tool is a spreadsheet. Recap of the webinar by Regan Camp Managing Director MST Advisory. Therefore adoption of the CECL model will require a well.

Web Example 6 in ASU 2016-13 illustrates one way to implement the collateral-dependent concepts. Using Loss Rates in CECL Calculation. Web the calculations of ACL.

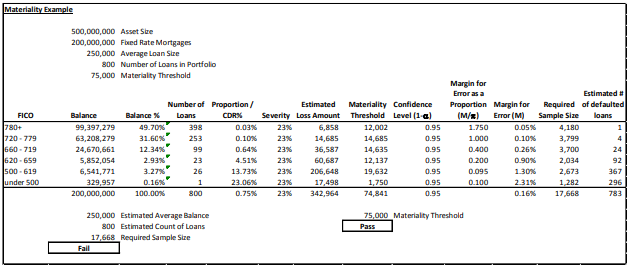

Web The following sections detail the CECL calculation for accounts both with and without undrawn amount as mentioned in the preceding sections. Web Banker Resource Center Current Expected Credit Loss CECL For all institutions early application of the CECL methodology is permitted for fiscal years beginning after. Web An example of a CECL calculation for a portfolio of residential real estate loans is attached as Appendix A.

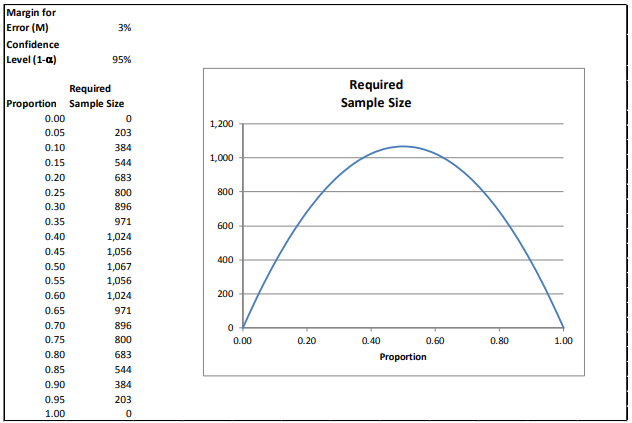

For example if a loan pool has an average life of five years and a loan is renewed at the end. The SCALE method uses proxy expected lifetime loss rates in calculating CECL estimates. What is Cohort-Level Analysis.

Web The Simplified CECL Tool provides a methodology for credit unions to determine the Allowance for Credit Losses ACL on loans and leases for their loan. Web FASBs new accounting standard ASU No. 25 The example below is based on Example 6 in the standard.

![]()

Four Key Questions When Estimating Current Expected Credit Losses Cecl Fi Consulting

Leveraging Historical Loss Data For Cecl

Cecl Methodologies And Examples Cecl Resource Center

Leveraging Historical Loss Data For Cecl

Understand The Current Expected Credit Loss Cecl Modeling By Michael Owusu Nkwantabisa Medium

Methods To Estimate Current Expected Credit Losses Gaap Dynamics

Leveraging Historical Loss Data For Cecl

Implementing Cecl The Warm Method Wipfli

Leveraging Historical Loss Data For Cecl

Cecl What S On Tap For The Future Of Credit Loss Moody S Analytics

Leveraging Historical Loss Data For Cecl

Choosing A Cecl Methodology Riskspan Cecl Solutions

Implementing The Current Expected Credit Loss Cecl Model White Paper Wilary Winn Llc

Understand The Current Expected Credit Loss Cecl Modeling By Michael Owusu Nkwantabisa Medium

Understand The Current Expected Credit Loss Cecl Modeling By Michael Owusu Nkwantabisa Medium

Cecl Raising The Standards Of Success Miac Analytics

Methods To Estimate Current Expected Credit Losses Gaap Dynamics